Regulatory Alignment & Compliance

- AquaCredit Blockchain

- Oct 21, 2025

- 2 min read

Given AquaCredit's pioneering nature, this section is crucial for assuring regulators and institutional users (investors, ESG officers) that the platform operates with legal certainty and policy alignment. We turn compliance into a competitive advantage.

Alignment with Key EU Regulations

MiCA Compliance (Markets in Crypto-Assets)

AquaCredit is being developed to align with the EU's MiCA regulation, providing a high degree of transparency and consumer protection.

Asset-Referenced Token (ART): The AquaCredit token (ACT) likely qualifies as an Asset-Referenced Token under MiCA, as its value is tied to a real-world asset (1 \ m3 of verified water).

Proactive Registration: GreenChain (the developer) plans to register under MiCA and obtain authorization as an ART issuer, including implementing strict KYC/AML processes and reserve safeguards.

Assurance: By meeting MiCA's high standards (transparency disclosures, capital requirements), AquaCredit offers legal certainty to large investors and utilities, ensuring they can use ACT without regulatory risk.

A "MiCA Compliance Summary" PDF will be available for regulators, outlining how AquaCredit fulfills whitepaper, audit, and governance requirements.

CSRD & ESG Reporting (Corporate Sustainability Reporting Directive)

AquaCredit serves as a vital tool for corporate sustainability compliance.

Water Transparency Mandate: CSRD legally mandates large companies to disclose detailed ESG metrics, including water usage and stewardship.

Compliance Tool: Companies can integrate AquaCredit Boxes to demonstrably improve water management or purchase ACT tokens to offset their water footprint.

Credible Data: The platform provides real-time, credible data on cubic meters of water saved, directly easing the manual effort for ESG officers and fulfilling CSRD reporting obligations.

SFDR (Sustainable Finance Disclosure Regulation)

AquaCredit helps investment firms and funds meet SFDR disclosure requirements for sustainable portfolios.

Measurable Impact: ACT provides a verifiable environmental outcome (water saved) that investments can be tied to, helping asset managers meet SFDR criteria.

Sustainable Investment: Investments in AquaCredit-backed projects or tokens can qualify as sustainable, contributing to the water-related environmental objectives defined by EU frameworks.

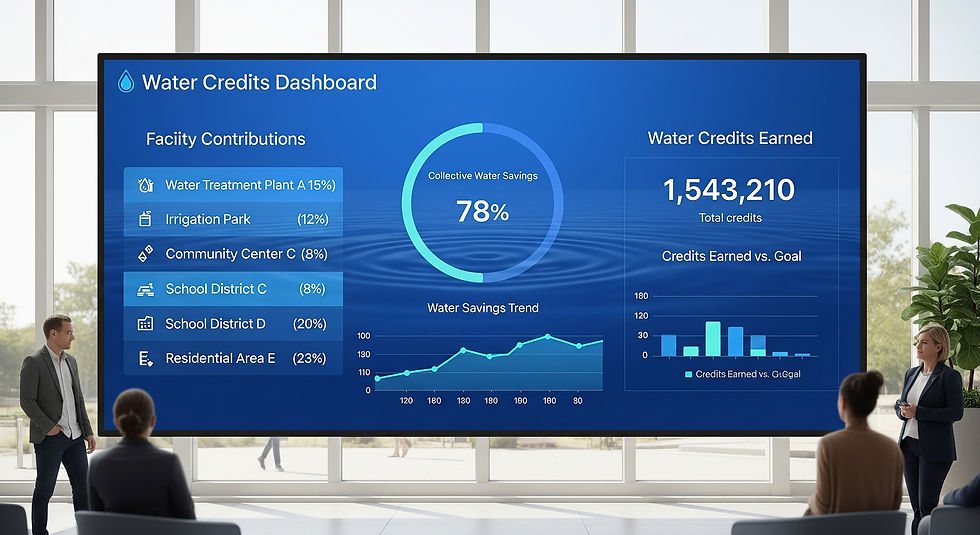

Data Provision: We offer data points (total water credits generated, etc.) needed for SFDR reporting, enabling financial products to quantify their positive impact.

EU Taxonomy & Green Finance

The platform directly supports the EU's framework for environmentally sustainable economic activities.

Taxonomy Alignment: AquaCredit projects (water recycling, atmospheric water generation) align with the Taxonomy's objective of sustainable use and protection of water resources.

Evidencing Sustainability: By tokenizing the outcomes, AquaCredit provides clear, auditable evidence and data to prove a project's alignment with taxonomy goals, increasing the confidence of banks and investors in financing these deployments.

In sum, the regulatory section reassures stakeholders that AquaCredit is fully compliant and uses policy alignment as a core competitive differentiator.

Comments